Online Services:

The gender pay gap and gender pensions gap

Over the years, increasing attention has been given to the fact that men historically earn more than women – the ‘gender pay gap’ and how to close or narrow this gap.

Today, public and private sector employers with 250 or more employees are required to annually publish data on the gender pay gap within their organisations.

Over time, the gender pay gap has been shrinking. In fact, recent data shows little difference in median hourly pay for male and female full-time employees aged in their 20s and 30s, but a more substantial gap emerges among full-time employees aged 40 and over.

The reasons for the gender pay gap are complicated. However, parenthood is a major factor - the gap between male and female hourly earnings grows gradually but steadily in the years after parents have their first child.

This difference in earnings across working life has also lead to a ‘gender pensions gap’. With lower earnings, more gaps in work history and the pay gap being more pronounced in the past, many women retiring today have significantly less pension wealth than their male counterparts.

On 5 June 2023, the Government published its first report on the gender pensions gap. This confirmed a 35% gap in private pension wealth between men and women who are at or approaching normal minimum pension age, albeit the gap is smaller at 32% for those who are eligible for Automatic Enrolment.

Potential pitfalls and planning points

There are a number of steps that can help protect the future pensions of those who are working part time or have taken time out of paid work to care for others.

- Maternity leave – When maternity leave (or shared parental leave) is taken, it’s important to understand what will happen to pension contributions and considering whether there is any scope to top these up.

Employee contributions are normally deducted as a percentage of pay. As pay will usually be reduced, any employee contributions will be paid at the same percentage as before, but based on the lower income. However, employer pension contributions are based on the employee’s normal salary which he or she would have been paid when they were still at work.

Note that where salary sacrifice is used, the member’s salary has been exchanged for equivalent employer contributions. This means that for a salary sacrifice arrangement, all contributions are technically employer contributions and therefore should normally remain at their prior level during the leave period and should not be reduced at all.

- Contributions for a lower earning partner – Where one partner in a couple stops working or earns less, the higher earner can make tax relievable pension contributions on their behalf. This may offer tax advantages in retirement, especially where the lower earner has less overall pension wealth and is likely to be a lower tax payer in retirement.

Tax relievable pension contributions can be made up to the higher of £3,600 (£2,880 net) and a scheme members relevant UK earnings each year. However, other factors such as the amount of tax relief available to each partner and availability of matching employer contributions will need to be taken into account.

- Incorrect NI records - Where someone claimed Child Benefit before May 2000 and did not provide their National Insurance Number on the claim, their National Insurance record may not show the correct number of qualifying years for the state pension - Women in their 60s and 70s are most likely to be affected.

The Department for Work and Pensions (DWP) and HM Revenue and Customs (HMRC) are working to find people affected and correct their records so they receive the correct amount of State Pension. Further information for those who may be affected can be found on the government services website.

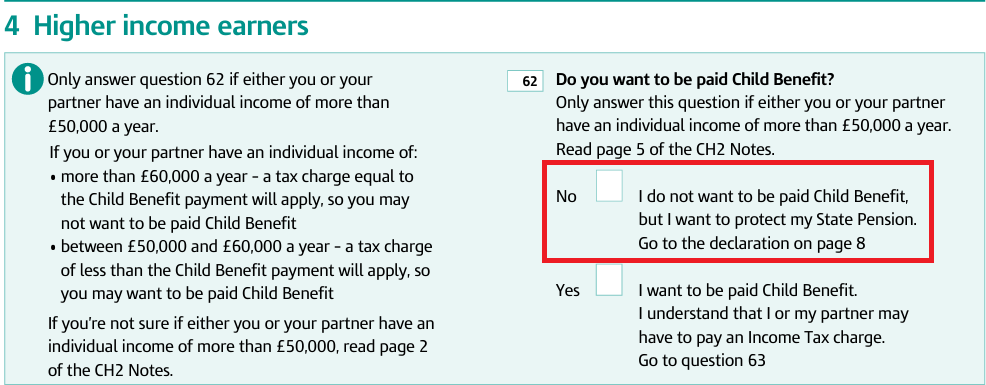

- Claiming child benefit today – For households where one partner earns more than £50,000, the ‘high income child benefit charge’ becomes payable. Once earnings reach £60,000, the tax is equal to any child benefit claimed, so it may seem pointless to claim child benefit.

However, where someone has taken time out of work to look after children, they should still always make a child benefit claim to ensure they get NI credits (35 years’ worth are needed for a full state pension). As part of the application process, it is possible to opt out of actually receiving any payment so as to avoid the tax charge (as highlighted below):

- Voluntary NI contributions – Where someone hasn’t a full National Insurance (NI) record, they may not qualify for certain benefits or a full state pension. Where someone has NI gaps within the past 6 tax years, they can make voluntary contributions to make up these gaps.

Furthermore, for men born after 5 April 1951 and women born after 5 April 1953, there is a temporary extended deadline (until 5 April 2025) allowing for voluntary contributions to be made to make up gaps in NI records between tax years April 2006 and April 2016.

Comment

The implications of the gender pension gap affect not just women and can cause financial implications for the whole household as individuals approach retirement.

Having awareness of the factors mentioned above can enable entitlement to a full state pension and help ensure gaps in work history do not lead to financial hardship in retirement.

If you have any questions around this or any other technical matter, send your query to [email protected].

Important Information

Please note this is for general information only and is based on LV=’s understanding of the relevant legislation and regulations and may be subject to change.

The tax treatment of benefits depends on individual circumstances, and may be subject to change in the future.

The use of this document is at your own risk, and the content should not be used for the provision of professional advice.

LV= accept no liability for any damages, losses or causes of action of any nature arising from your use of this document.