Online Services:

Wealth and Wellbeing Research, Edition 11 – the key findings, and what they mean for financial advice

In our long-running study we have been researching the financial habits and wellbeing of the nation in our Wealth and Wellbeing programme since June 2020. Triggered by the Coronavirus pandemic and the unprecedented impact it had on the financial markets, we wanted to understand how consumers were faring with their finances, and we’ve continued to do this every quarter since.

Almost three years on, we continue to see volatility in the markets and the advisory sector is gearing up to meet its responsibilities under the Consumer Duty Act, designed to better protect consumers from foreseeable harm and empower them throughout their financial journeys.

With this unpredictable backdrop it’s important to understand how consumers are feeling.

What does financial uncertainty mean for advisers?

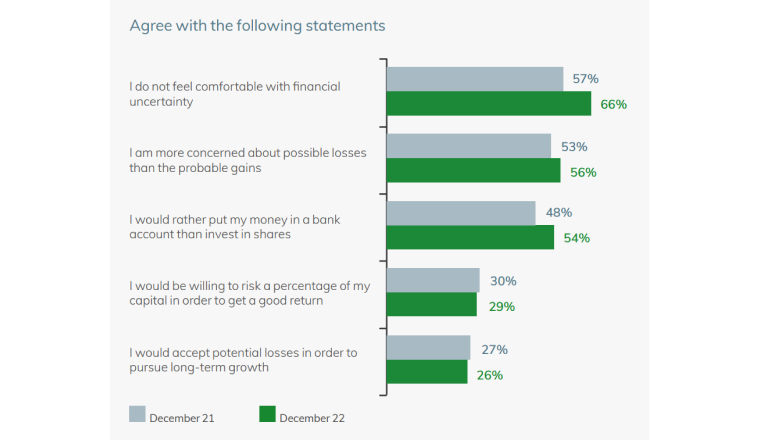

Two thirds (66%) of UK adults said they do not feel comfortable with financial uncertainty, and we see a much lower risk appetite in female consumers, with 75% answering “I do not feel comfortable with financial uncertainty” compared to 56% of men.

For advisers this presents a challenge. Traditionally, a risk averse client might opt to hold significant amounts in cash to avoid stock market volatility. Clearly this method may be more comfortable for the client in the first instance, but their capital will be devalued in real terms by inflation which could impair their ability to meet their long term objectives. On the other hand, a client may decide to invest in order to see more compelling returns, but experience stress if their investments dip and feel the urge to sell during volatile times.

A possible solution is the addition of smoothed funds, either as the primary investment vehicle or as an additional asset class to reduce the volatility experienced by the client without sacrificing market participation.

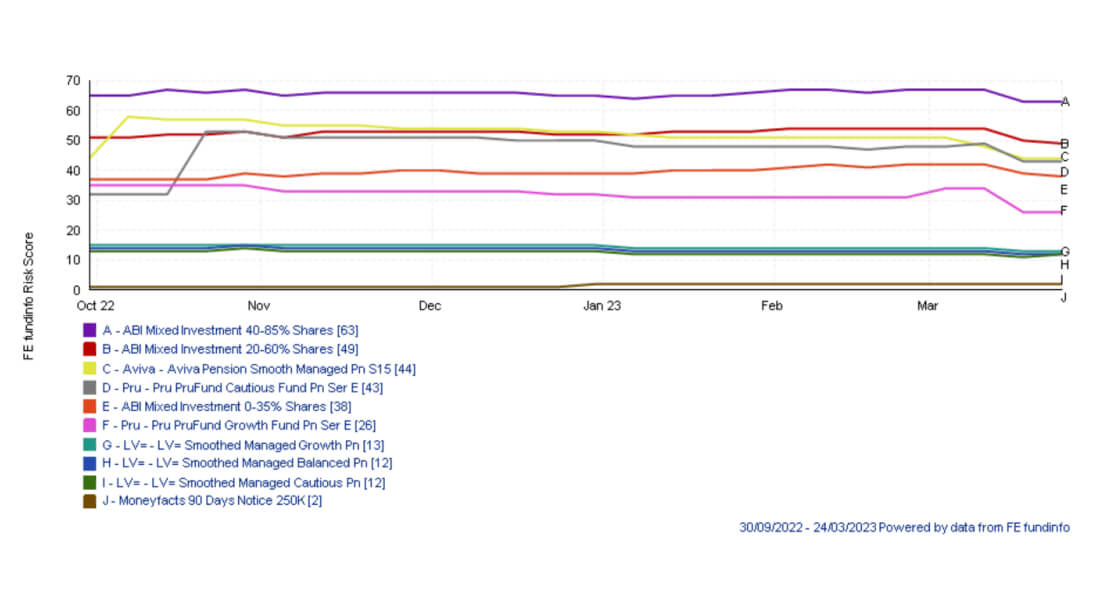

Our smoothed funds are designed to reduce the volatility experienced by investors, whilst offering compelling returns. According to their FE fundinfo risk scores, the funds behave as similarly to cash as possible in the sector. This makes them ideal for the 56% of consumers who, when faced with a financial decision, stated they are ‘generally more concerned about the possible losses than the probable gains’.

Learn more about the risk ratings of our Smoothed Managed Fund range.

What are consumers looking for when it comes to pension investments?

As consumers, including clients in decumulation, face such uncertainty and rising prices it was no surprise to see that 54% state fluctuations in the value of their pension makes them anxious, and 3 out of 4 (equivalent to almost 10 million UK consumers) would prefer their retirement savings to be invested in a way that ensures growth whilst also smoothing out any fluctuations in value.

Over a third (37%) of workers with a DC pension said that, in retirement, their preference would be to receive both a set income and have a pot of money to draw from.

Our blended solution

We could support you to meet this client appetite through our blended solution, a smart combination of a fixed term annuity, securing a guaranteed income and secure capital, and smoothed investments for growth potential.

This unique solution comes with more flexibility to help your clients plan for the long term, as they won't need to tie themselves down to a decision which isn't adaptable to their future financial needs. You have the ability to create a bespoke recommendation for your client based on their individual circumstances, while demonstrating you are seeking to avoid foreseeable harm.

The appeal of this kind of option is backed by our research. Over a third of workers with a DC pension said that in retirement their preference would be to receive both a set income and have a pot of money to draw from. Those close to retirement (aged 55-64) were particularly keen on this option, with 47% selecting it as their preferred option.

To view the full report, Wealth and Wellbeing Research Programme Edition 11, click here to download for free.

______________________________________________________________

Source: LV= Wealth and Wellbeing Research Programme, December 2022, Edition 11.

This stock market related investment can rise and fall in value. This means clients are not certain to make a profit and your client could get back less than they invested.

Smoothing can be suspended at our discretion if either the underlying price is 80% or less of the averaged or 'smoothed' price, or in exceptional conditions. The fund will typically be valued on the underlying price, or at our discretion, the fund may be valued on a daily gradual averaged price until smoothing is reintroduced (except ISA which would be valued on the underlying price).