Online Services:

Three consumer trends every adviser should know

Our flagship Wealth and Wellbeing Research Programme marks its 3rd anniversary with the publication of Edition 13 this month. We’re proud to reach this milestone, as it makes this one of the longest running studies of its kind.

So, what are the three key findings we think every adviser should know?

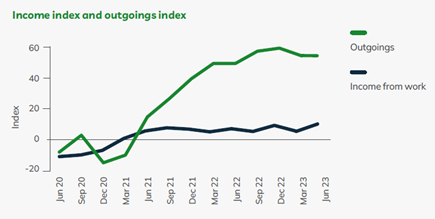

1. Consumer outgoings remain high, but outlook improves

While it will be no surprise to see outgoings remain high among consumers, the stark contrast between outgoings and income might be concerning to those in the financial planning space. This might equate to increased withdrawals from savings or pension investments, beyond what the consumer had planned for, which could be a risk to their financial objectives.

Looking further into the underlying data we can share that 7% of those aged 55+ said their living costs had not increased, although 58% said they were saving less, 55% said they’d dipped into their savings and 7% had stopped or were paying less into their pension.

These statistics paint a clear picture of a cohort of workers nearing retirement that are already diverting from their financial plans. When they reach the pivot point of secure income to retirement income they may be in an anxious position, and good financial advice that takes their composure and their objectives into account will be essential.

2. Half of adults aged 35-54 described their financial situation as “struggling”

51% of people aged 35-54 described their financial situation as “struggling”. That equates to 22 million UK adults; 6 million more than during the pandemic.

For retirees, this figure was 27%, and looking specifically at Mass Affluent consumers (those with between £100,000 and £500,000 of assets excluding property) the figure was 16%.

People aged 35-54 are often referred to as the ‘stretched middle’ as they typically have more financial responsibilities, such as children, mortgage, pension contributions, elderly parents, making it no surprise that the cost of living crisis is hitting them particularly hard.

As we are seeing more people feel the strain of inflation and high living costs, from those relatively early in their working life to those who’ve already retired, advisers might look to de-risk all, or a portion, of their client’s portfolio using lower volatility investment solutions, like smoothing.

Smoothed funds like our Smoothed Managed Funds range aim to give clients a calmer investment journey while targeting growth. This type of investment could provide comfort to those slightly further from retirement who want an investment that balances their appetite for volatility in these difficult times with their appetite to remain invested, as well as those firmly already in retirement who are seeing their financial outgoings change.

Please remember that the value of investments can go down as well as up, so your client might get back less than they put in.

Smoothing can be suspended at our discretion if either the underlying price is 80% or less of the averaged or 'smoothed' price, or in exceptional conditions. The fund will typically be valued on the underlying price, or at our discretion, the fund may be valued on a daily gradual averaged price until smoothing is reintroduced.

3. Almost a third of retirees helped friends or relatives financially

This edition reveals that 29% of retirees have helped friends and/or family financially in the last 6 months. The main reasons given were to help with day-to-day costs (39%) and to help the friends/family to pay their bills. Only 7% stated the reason as “To give them a living inheritance (pass on some of your money whilst you are alive)”.

This comparatively low figure suggests that while retirees are eager to help friends and family, they may not be seeing this through the frame of intergenerational planning, and are unaware of the most efficient way to do so.

We also found that 13% gave this help using their pension, either through their monthly income or drawdown. The average amount given was over £7,000.

If any of your clients are in this position, why not speak to them about intergenerational planning through Bonds and other tax-efficient means.

Finally, introducing the LV= Wellness Tracker

This edition also sees the introduction of the LV= Wellness Tracker – a figure out of 100 designed to offer an insight into how the nation is faring when it comes to their financial wellbeing.

Our latest LV= Wellness Tracker figure is +17. While the tracker is being published for the first time in this edition, we have collated the figures dating back over all 13 editions.

The Wellness Tracker figure remains less than half that of any figure in the pandemic. While a positive figure does mean that more people are comfortable than struggling overall, it is a concern that over 40% of respondents have been finding it hard to get by since December last year.

To see the full LV= Wellness Tracker data, as well as more findings from the research, download your copy of the report.