Online Services:

Smoothing, simplified

We learn from Head Wealth Proposition, Kirsty Wright, why smoothed funds are the ideal investment solution to provide your clients peace of mind.

What is the LV= Smoothed Managed Fund range?

The LV= Smoothed Managed Funds are a range of five multi-asset funds, which benefit from our unique smoothing mechanism. We launched the range in 2006 with what was then called our All-in-one Bond, and they’ve evolved and grown since then.

What was the core idea behind launching the funds?

We wanted to create a fund range that was aligned with our mission as a business to help people live confident lives. And, we wanted to give clients an investment option that offered a calmer journey, empowering them to stay invested when markets got rocky, which we know is the key to long-term positive outcomes.

There are a few smoothed fund providers in the market. How are LV’s smoothed funds different?

Our main differentiator is how our smoothing mechanism works.

It operates on a backward-looking basis, so that a client’s fund is always an average of the previous 26 weeks fund values*. This means that short term market drops are averaged out and don’t have the same impact on the client but, at the same time, growth can be slower than unsmoothed funds. It is still a stock market investment, so of course values can go up and down, but the aim of the fund is to smooth those fluctuations.

Can you describe the performance of the funds?

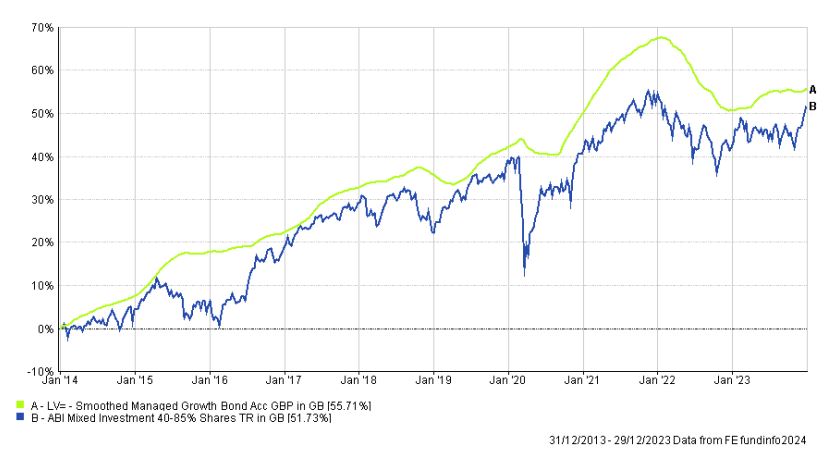

The funds have been successfully providing investors with growth over the medium to long term since they were launched 18 years ago. Our LV= Smoothed Managed Growth Fund had positive performance of over 55% in the ten years to December 2023, whilst giving investors that smoother journey, as shown in the chart.

Our funds have already provided valuable comfort to investors during difficult times as they did not snap in either the financial crisis in 2008/09 or Covid-19 in 2020.

How can they be accessed?

We currently have a Pension, Bond, ISA and the ability to access the funds through a TIP. We also have an adviser portal to make managing your LV= clients easier. Later this year, we’re also bringing our funds on platform with LV= Platform Services. This will bring in an on-platform SIPP, Junior SIPP, ISA and JISA – all of which will allow you to select and manage LV= Smoothed Managed

Funds with all the benefits and ease of a platform.

Find out more about LV's Smoothed Managed Funds and how they can benefit your clients.

*For a full explanation of LV’s smoothing mechanism across all wrappers, please visit lvadviser.com/smoothed-investments

Please remember that past performance doesn’t reflect what will happen in the future. The value of investments can go down as well as up. This stock market related investment can rise and fall in value. This means you’re not certain to make a profit, and you could get back less than you invested. Smoothing can be suspended at our discretion if either the underlying price is 80% or less of the averaged or 'smoothed' price, or in exceptional conditions. The fund will typically be valued on the underlying price, or at our discretion, the fund may be valued on a daily gradual averaged price until smoothing is reintroduced (except ISA which would be valued on the underlying price).